Last month, we held our first Venture Forum of the year in San Francisco. Verizon brought together a group of thought leaders comprised of entrepreneurs, VCs and corporate peers to discuss the future of artificial intelligence (AI). Over the last couple years, AI has been gaining traction in a number of sectors and has become somewhat of a buzzword, oftentimes used by companies to appear ahead-of-the-curve. As a level-set, we started the day by simply defining AI as “the science and engineering of creating intelligent machines,” with intelligence pertaining to the ability to communicate, reason, problem solve (like stamping out fake news), plan, perceive, and create.

While AI has been around for some time, the advancements in algorithms, computing capabilities, and available datahave all helped AI become one of the key technologies of the future.

We spent the day exploring trends and innovations across topics such as natural language processing, image recognition, security and robotics. Below are three key takeaways from the day:

The convergence of technologies will drive verticalized applications of AI

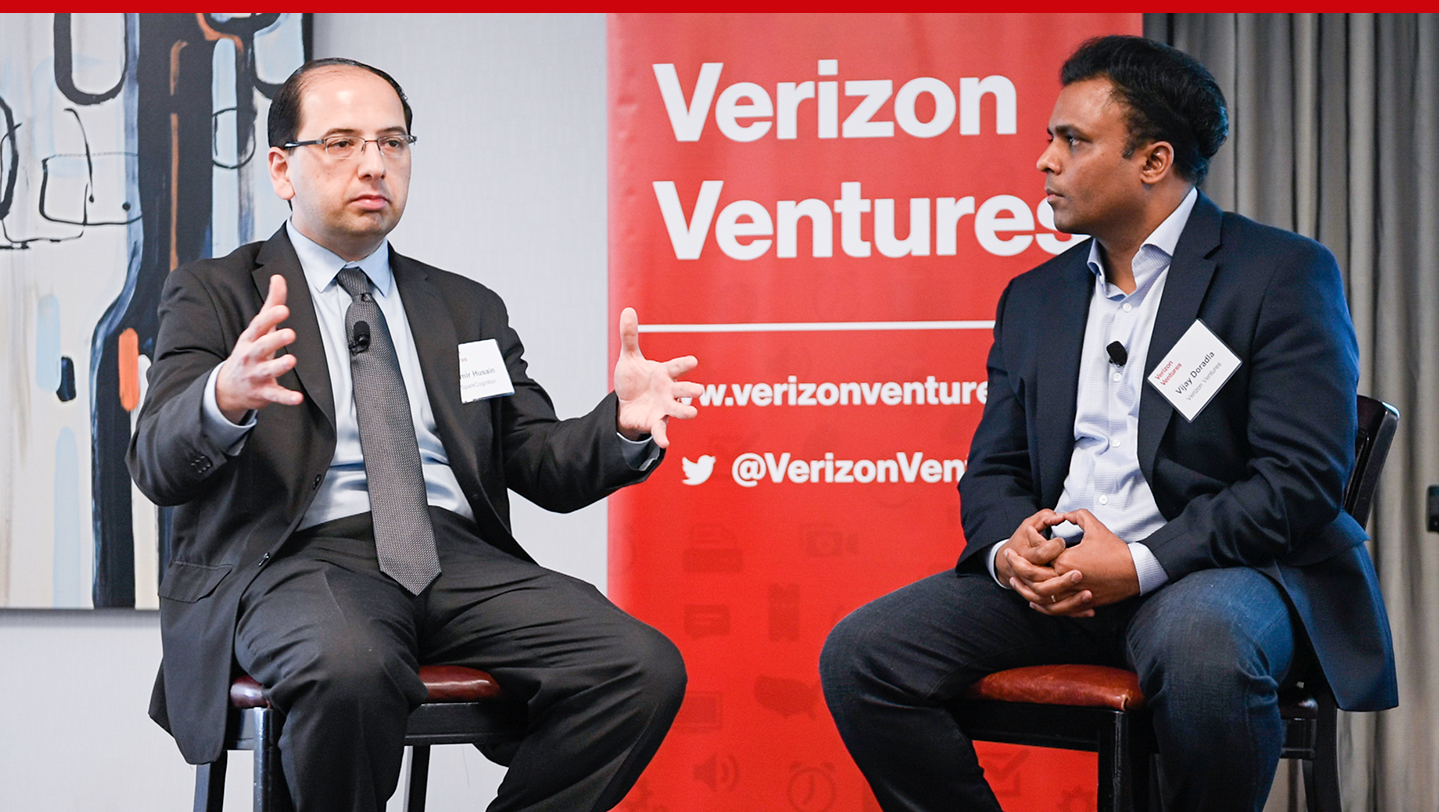

Verizon Ventures’ Vijay Doradla conducted a fireside chat with Amir Husain, founder and CEO of SparkCognition, a Verizon Ventures portfolio company. Amir shared his prediction of technologies, such as Big Data, IoT, sensors, edge computing, and AI, among others, coming together to create a new class of capabilities that will drive powerful solutions. While many people believe that artificial general intelligence (AGI) will arrive when humans can have a dialog with a computer and not realize it’s a machine (also known as the Turing test), Amir believes today’s AI can solve specific problems, which he refers to as artificial specialized intelligence (ASI).

SparkCognition is doing just that with their platform which focuses on securing the energy industry — overtime, the platform will be tweaked for other industries. Currently, SparkCognition’s predictive maintenance platform is being deployed in industrial industries including oil and gas, utility, manufacturing, aerospace, and is continually looking to expand into other industries. We also heard from another startup, who has a slightly different go-to-market strategy. Their approach is to solve specific pain points for its customers, then leverage its domain expertise to build custom solutions for other companies within the same industry. While highly verticalized applications may not be the future of AI, it appears to be today’s winning strategy (Click to Tweet).

Unique approaches to investing in the AI industry

T.M. Ravi, co-founder of The Hive, shared his views on how AI will affect the future of business. The Hive is an investment fund and incubator focused on funding and co-creating AI startups that aim to transform enterprises from a system of record (data source for a given piece of information or data element) to a system of decisions (a tool that supports the analysis involved in decision-making processes), leveraging deep learning as the key enabler. The goal is to create the autonomous enterprise by removing people from the process, so instead of making decisions they can spend time setting and enforcing policies.

In a more business model-centric approach, a partner at a top-tier West Coast VC firm, shared how he focuses more on identifying startups that can demonstrate competitive advantages with data. He believes the crown jewel of any AI business is data — not necessarily the algorithms themselves, as most AI-first startups don’t have the data to feed their algorithms (Click to Tweet). Therefore, he views companies that can build “data moats,” essentially raising the barrier of entry when it comes to data collection, as most compelling. These data moats can typically be built by collecting data from workflow processes, which are utilized to help people perform their jobs better and faster.

Companies that can collect derivative or ancillary data from watching people do their job will further insulate themselves from competitors.

The speakers provided two unique approaches to investing in AI and what they typically take into consideration. As a corporate venture capital firm, we take a more balanced approach, seeking companies that have IP that can help Verizon, while also having a business model that helps it build intrinsic value, which helps our financial returns.

AI has some meaningful, recent successes, but it’s still early

This year’s forum concluded with a keynote from a well-known computer scientist and university professor. He believes AI has made significant advances in recent years, but machines are still far off from capturing human intelligence, such as time, causality, beliefs, emotion and justice. That being said, he did state that, contrary to popular belief, over time, machines will begin to possess human-like characteristics, such as emotions, free will, and consciousness. The reason for the disparity is not only does it seem unlikely in the near-term, but also because so many of us don’t understand the true essence of those emotions ourselves, which makes it “scary” (to hear how we can be more trusting of AI, listen to our podcasthere). He concluded with an optimistic perspective, that though far off, the future of AI shouldn’t be looked at as a scenario of humans versus machines, but rather humans and machines (Click to Tweet). While this may bring various types of disruptions with jobs, fairness, and security, he believes we will come out ahead, like we have with previous emerging technologies, and that AI will have a net benefit on society.

In summary, the purpose of our forums is to gather constituents from Verizon with third-party industry experts, to engage in discussions and provide deeper insights intended to prompt creative ideation. The enthusiasm around the topic, and the compelling conversations that took place set up this notion: the marketplace is going to embrace AI, and will create an environment we all need to operate in, irrespective of our understanding of how it will impact our future or whether we choose to play in the space directly. Finally, we would like to give a special thanks to Zeev Klein and the rest of the Landmark Ventures team for helping us produce another stellar event.

No comments:

Post a Comment