It took less than 5 mins for me to activate and transfer money from my China Merchant’s Bank account to a friend.

Using facial recognition, the smartphone app directed me to tilt my head, blink my eyes and hold my face still to authenticate the transfer.

I was impressed.

Facial recognition is gaining traction at a startling pace in China. Real-world applications already range from verifying Uber drivers toidentifying people seeking to withdraw cash from an ATM without a debt card. Chinese startups in this space have attracted serious funding: Face++ was most recently valued at $1B.

Why is China starting to lead in this space?

- Data availability. As machine learning algorithms become more and more commoditized, access to huge volumes of training data is starting to become the core competitive advantage. One instantiation of this can be seen in the Face++ / Meitu partnership, through which Face++ gained access to Meitu’s 850M user-strong dataset. Other Chinese AI companies are also finding their way to get into banks, telcos, mobile phones etc. Chinese users have different notions of and expectations for privacy; this is something domestic Chinese companies have been capitalizing on with little resembling the backlash we would expect in the US. Word on the street is that some companies even sell phone conversations in different accents to train speech recognition software.

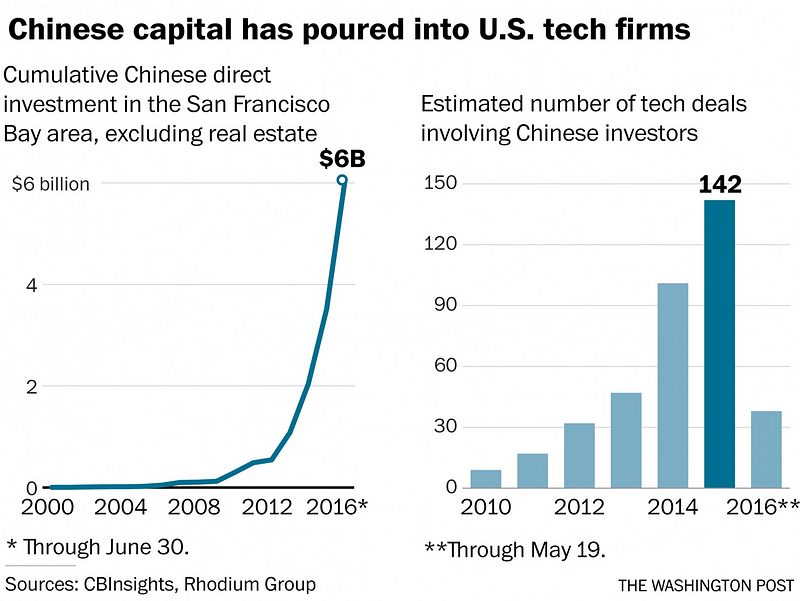

- Cash money. Some Chinese investors are focused on near-term financial return when investing but many are looking for a China angle. Datavisor, a Silicon Valley software company that analyzes anomalous security patterns, has raised a significant amount from a Chinese investor and signed both American clients like Yelp and Chinese clients like Momo (NASDAQ:MOMO). The magnitude of Chinese capital being poured into AI startups in the Valley is deeply under-appreciated today. Some investments have already started to result in collaborations or JV that benefit both sides. The JV between JD.com (NASDAQ: JD) and ZestFinance, for example, will leverage ZestFinance’s machine learning-based credit-decisioning technology and JD.com’s reservoir of consumer data to provide credit risk evaluation services to companies in China.

On the M&A side, Chinese companies have already set a record for outbound M&A this year. Many are still actively looking to acquire AI companies such as speech recognition (also VR, AR companies etc.).

3. No incumbent systems and processes. Modern financial systems and instruments came to China late. It was only in the early 2000s that credit cards became somewhat common; even then, due to the lack of credit histories, users were made to deposit large amounts of money to gain access to credit. When I got my first “credit card” in 2004, I had to deposit $800 in order to spend $800. Today, Chinese lenders work with startups that provide not only US-style credit bureau histories but also richer data such as a borrower’s e-commerce purchase history, social media reputation, and so forth. The resulting credit models are significantly more sophisticated than those in the US. Whereas it will probably be a long time before the American credit system will begin mining rich user data for credit purposes, Chinese systems are leapfrogging into the 21st century.

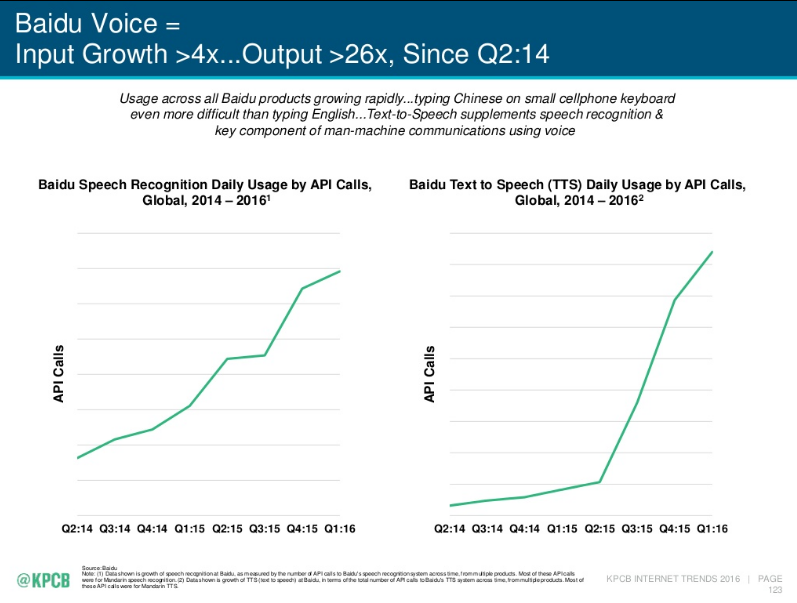

4. Access to talent. China traditionally has strong math training which has already generated a large number of data scientists domestically. In addition to hoovering up US-trained computer science PhD returnees like Megatron on any given Sunday, most major tech companies have set up serious R&D operations in the Valley. Baidu has a team of ML scientists focusing on speech recognition under the leadership of Andrew Ng. They’ve made significant progress in speech and have even begun to approach Google as evidenced by the growth of API call frequency and the accuracy of speech recognition, see below two charts (source).

Originally published on Medium through Startupgrind

No comments:

Post a Comment